Investor FAQs

1. How do I sign up as an Individual or Corporate Investor?

- User clicks on the “INVEST” tab, they will be redirected to a screen where they must choose whether the user wants to register as an Individual or Corporate.

- User to fill up the basic relevant details

- Upon registering, user will be redirected to another screen whereby the user needs to fill up additional information to complete the full registration process.

- User to make an initial Deposit of RM5 prior to any investment. Moneysave only accepts investments via FPX/Payment Gateway and Moneysave does not accept remittance from any Third Party.

2. Who is eligible to be an angel investor?

- User must declare an individual annual income of the below to qualify as an angel investor:

- User have at least RM180,000 or above (or foreign equivalent)

- User have a net worth of more than RM 3 Million

- User and Spouse have a joint annual income of RM250,000

- Being an angel Investor, the user is allowed to invest more than RM50,000 on the platform at a given time.

- It is a self-declaration process and hence Moneysave may not require any supporting documents

3. Who can invest?

You can be an Investor as long as you are at least 18 years of age.

We accept investors from anywhere in the world as long as you are above the minimum age, having a registered bank account with Banks in Malaysia and not a US Tax resident.

No third party transfer of deposits / funds by user is allowed.

4. Making a deposit

- User to click deposit button in the user portal. Moneysave only accept payment via FPX/Payment Gateway.

- User to key in the investment amount and this will redirect user to the FPX facility. (Note that the initial deposit amount is RM5, and subsequently is minimum RM5)

- Any deposit / funds by the user would be held in a trust account managed by an independent licensed trustee (Maybank Trustees Berhad). This is to mitigate the risk of your funds being misused.

5. Request for withdrawal

- User to click request withdrawal button in the user portal.

- User can withdraw any amount (minimum RM1.00) up to the total of your available balance displayed in your account. There may be charges for withdrawals and you can withdraw as many times as you like.

- Any withdrawal request will be processed within 3 business days as withdrawal are paid through GIRO into the user’s registered Bank Account.

6. How to invest?

- User to log in into the account.

- Go to browse investment opportunities in the portal.

- Click to view factsheet of the various Investment Notes which would provide details of the financial and business information of an Issuer.

- Input the amount you want on various Investment notes to invest under the “Investment Amount” shopping cart. Click on “Check Out” to complete your investments.

7. Can I cancel my investment?

- User is unable to withdraw any Investment Note once the Investment Note is committed.

- Any withdrawal would:

- disrupt the financing process and delay the funds being disbursed.

- Be unfair to other Investors who may have wanted to invest in the same investment opportunity, but missed out because the financing notes was fully funded.

8. Service Fee Charges

- Service Fee is deducted when repayment is paid to the Investors

- Service Fee is not subject to SST.

9. Do I have to declare tax?

- User is responsible to pay the applicable tax on your interest earned if you are a Malaysia Tax Resident.

- User may refer to the account statement for the tax declaration.

- User may declare the Interest Income as following formula:

Interest Income = (Interest Received + Late Interest Fee Received + Early Interest Fee Received – Service Fee)

10. Repayment computation

- The repayments shall be distributed back to the Investor’s account within 30 days grace period of receipt of the repayments from the Issuer taking into account the buffer to accommodate bank transaction delays and unforeseen circumstances.

- Moneysave does allow for early full settlement with an early full settlement fee chargeable to the Issuer to compensate the loss of the remainder interest on the financing term.

- All Issuers may be given (7) calendar days grace period to make the repayments due. The grace period is calculated from the due date of the Repayment. If the issuer fails to make the full repayment within seven (7) calendar days, Late Payment Interest (LPI) will be incurred and calculated from the due date based on the outstanding repayment amount and distributed to the investors for the delay. Moneysave may waive this LPI if repayment is made within seven (7) days of Repayment due date.

- The Repayment formula based on type of financing as following:

*Service fee varies depending type of financing.

11. What is a Default Note?

- The Investment Note being overdue in payment for more than sixty (60) calendar days for Trade Invoice Financing and ninety (90) calendar days for Other Financing from the Payment Due Date;

- The Issuer or, in relation to Trade Invoice Financing, the Issuer’s trade debtor(s)/creditor(s) go into administration or liquidation (as the case may be);

- The Issuer or, in relation to Trade Invoice Financing, the Issuer’s trade debtor(s)/creditor(s), ceases or threatens to cease carrying on a substantial portion of its business;

- The P2P Operator suspects that fraud has been or may be committed by the Issuer or, in relation to Trade Invoice Financing, the Issuer’s trade debtor(s)/creditor(s); and/or Moneysave may classify any of the Investment Notes as Default Investment Note upon the occurrence of any of the events as following:any breach by the Issuer of its obligations in the Issuer Agreement executed between the Issuer, the P2P Operator and the Trustee, in particular but not limited to the occurrence of an Event of Default as defined in the Issuer Agreement.

- User clicks on the “New Investor” tab, they will be redirected to a screen where they must choose whether the user wants to register as an Individual or Corporate.

- User to fill up the basic relevant details and register as an Investor

- An email activation will be sent to the user’s registered email.

- Upon activation, user to log in and will be redirected to another screen whereby the user is required to provide additional information to complete the full registration process. A confirmation email will be sent to user upon successful onboarding.

- User can proceed to make deposits.

- User must declare an individual annual income of the below to qualify as an angel investor:

- User have at least RM180,000 or above (or foreign equivalent)

- User have a net worth of more than RM 3 Million

- User and spouse have a joint annual income of RM250,000

- Being an angel Investor, the user is allowed to invest more than RM50,000 on the platform at a given time.

- It is a self-declaration process and hence Moneysave may not require any supporting documents

You can be an Investor as long as you are at least 18 years of age.

We accept investors from anywhere in the world as long as you are above the minimum age, having a registered bank account with Banks in Malaysia and are not a US Tax resident.

No third party transfer of deposits / funds by user is allowed.

- User to click the Balance / Top-Upbutton in the user portal.

- Moneysave only accepts investments via FPX/Payment Gateway and does not accept remittance from any Third Party.

- User to key in the investment amount and this will redirect user to the FPX facility.

- Any deposit / funds by the user would be held in a trust account managed by an independent licensed trustee (Maybank Trustees Berhad). This is to mitigate the risk of your funds being misused or misappropriated.

- The minimum amount user can invest is RM1 per Investment Note via web portal and RM5 per Investment Note via Mobile apps.

- If you are a Retail Investor, the Securities Commission of Malaysia (SC) highly encourages you to limit your investments to RM50,000 at any period of time.

- User to click request withdrawal button in the user portal.

- User can withdraw any amount (minimum RM1.00) up to the total of your available balance displayed in your account. There may be charges for withdrawals and you can withdraw as many times as you like.

- Any withdrawal request will be processed within 3 business days.

- User to log in into the account.

- Proceed to browse investment opportunities in the portal.

- Click to view factsheet of the various Investment Notes which would provide details of the financial and business information of an Issuer.

- Input the amount you wish to invest in the various Investment Notes under the “Investment Amount” shopping cart of the respective Note. Click on “Commit Funds / Check Out” to complete your investments.

User is unable to withdraw any Investment Note once the Investment Note is committed in view that

Any withdrawal would both:

- disrupt the financing process and delay the funds being disbursed.

- Be unfair to other Investors who may have wanted to invest in the same investment opportunity, but missed out because the financing notes was fully funded

- Service Fee is deducted when repayment is paid to the Investors

- Service Fee is not subject to SST.

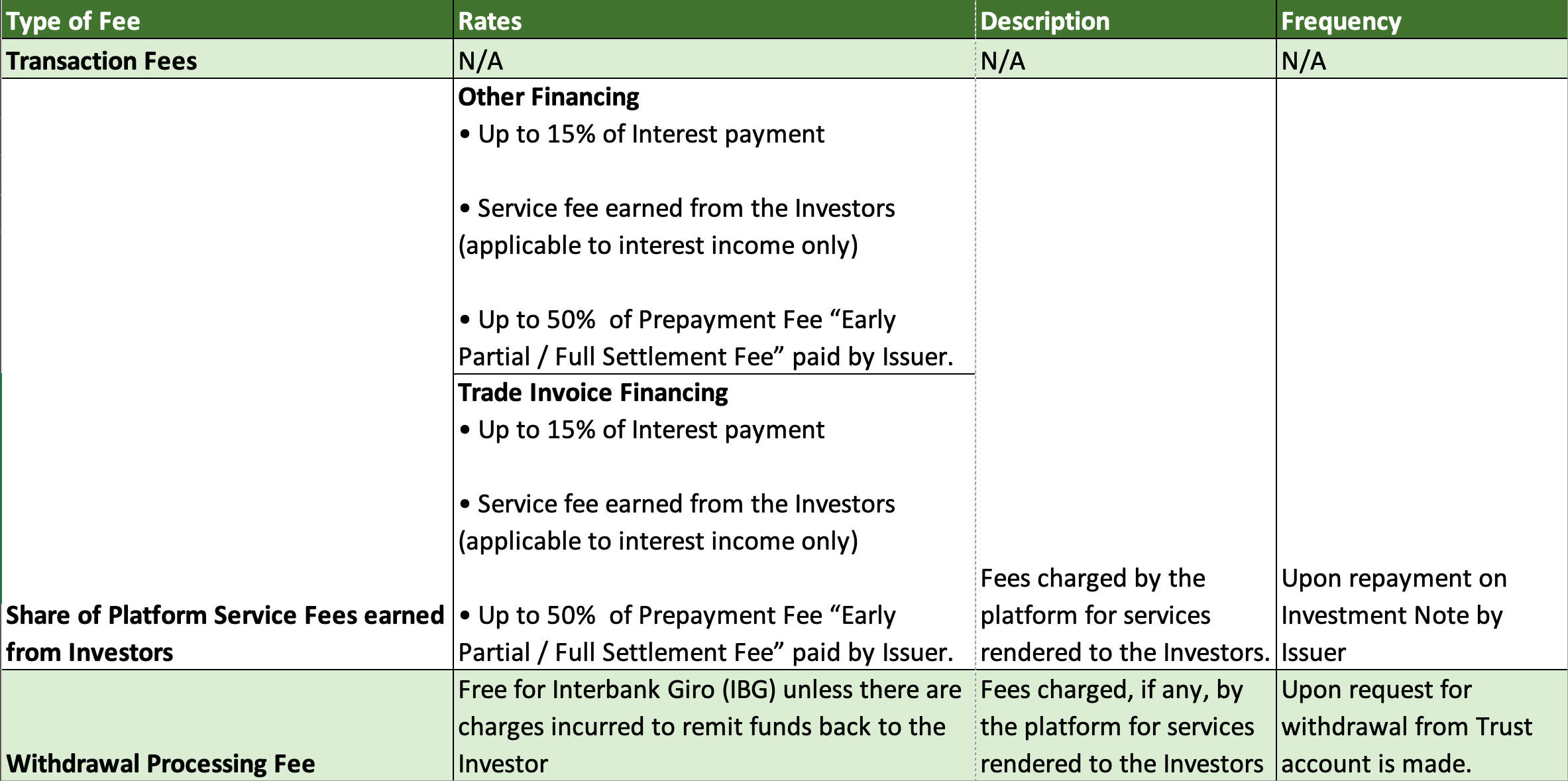

|

Type of Fee |

Rates |

Description |

|

Share of Platform Service Fees earned from Investors |

Up to 15% of investor’s profit rate. |

Fees charged by the platform for services rendered to the Investors. |

|

Withdrawal Processing Fee |

Free for Interbank Giro (IBG) unless there are charges incurred to remit funds back to the Investor |

Fees charged, if any, by the platform for services rendered to the Investors upon request for withdrawal from Trust account is made. |

- User is responsible to pay the applicable tax on your profit earned if you are a Malaysia Tax Resident.

- User may refer to the account statement (which can be generated in the mobile apps) for the tax declaration.

- User may declare the Profit Earned as per following formula:

Profit Earned = (Interest or Profit Earned + Late Interest or Late Profit Earned – Service Fee)

- The repayments shall be distributed back to the Investor’s account within 30 days grace period of receipt of the full payments from the Issuer taking into account the buffer to accommodate bank transaction delays and unforeseen circumstances.

- Moneysave does allow for early full settlement with an early full settlement fee chargeable to the Issuer to compensate for the loss of the remainingprofit on the financing term.

- The Issuers are given 7 days grace period to make the payment from the date that the payment is due. Thereafter, Moneysave may charge for late payment and/or any additional profits.

- Additional Profit where the Sales Price based on the Contracted Profit Period shall be accrued and payable. The amount accrued and payable shall be up to the Contracted Sale Price.

- Generally, the Payment formula based on type of financing as following:

|

Repayment Method |

Types of Investment Notes |

Not Due |

Early Partial / Full Settlement (if any) |

Overdue |

|

Bullet |

Conventional Investment Note |

Payment = (principal + simple interest earned) – service fee |

Full Settlement Repayment = (principal + simple interest earned / Settlement N-month + Prorated early Penalty interest p.a on Outstanding Amount – service fee |

Payment = (principal + simple interest earned + LPI * number of repayment overdue days) – service fee |

|

Bullet |

Islamic Investment Note |

Payment = (principal + simple profit earned) – service fee |

Full Settlement Repayment = (principal + simple profit earned / Settlement N-month + Prorated early Penalty profit p.a on Outstanding Amount – service fee |

Payment = (principal + simple profit earned + LPC * number of repayment overdue days) – service fee Profit includes additional Profit where the Sales Price based on the Contracted Profit Period. |

|

Monthly |

Conventional Investment Note |

Payment = [(principal + simple interest earned) / tenure] – *service fee |

Full Settlement Repayment = [(principal + simple interest earned) / Settlement N-month] + Prorated early Penalty interest p.a on Outstanding Amount – service fee |

Repayment = [(principal invested + simple interest earned) / tenure] + (LPI * number of repayment overdue days) – service fee |

|

Monthly |

Islamic Investment Note |

Payment = [(principal + simple profit earned) / tenure] – *service fee |

Full Settlement Repayment = [(principal + simple profit earned) / Settlement N-month] + Prorated early Penalty interest p.a on Outstanding Amount – service fee |

Repayment = [(principal invested + simple profit earned) / tenure] + (LPC * number of repayment overdue days) – service fee Profit includes additional Profit where the Sales Price based on the Contracted Profit Period. |

*Service fee varies depending type of financing.

Didn't answer your question?

Feel free to contact our team of specialist to help you find the answers to what you need.