General FAQs

Most frequent questions and answers

Moneysave is fully owned and managed by Moneysave (M) Sdn Bhd which is a Recognised Market Operator registered by the Securities Commission of Malaysia to operate a peer-to-peer financing platform.

Moneysave reviews and assess all applications before Investment Notes are allowed to be hosted on the platform by referring to the information sourced from official sources or information providers.

Investors then selects which Investment Notes they wish to invest in by submitting their offers on our platform. Investors can spread their risks by investing in different Investment Notes by which can be filtered. Moneysave intends to make the platform as affordable so that an investor can start investing from as low as RM1 via web portal and as low as RM5 via Mobile apps.

SMEs employ the majority of people in Malaysia, and their performance have a profound effect on the health of the economy. Moneysave would like to play a crucial role in developing the economy by assisting SMEs to raise financing and on the other hand, assist investors to gain access to opportunities and potentially gain more attractive yields and participate together in growing the Issuer’s businesses.

Moneysave’s role is to:

- Perform introductory functions on behalf of prospective Issuers and Investors for the issuance of Investment Notes.

- Provide a streamlined process for the issuance of Investment Notes (including the development of standard contract notes).

- Facilitate the payments and collection of sums due under or in connection with those Investment Notes (including taking certain actions on behalf of investors upon an issuer’s default or if the issuer becomes, or is likely to become, insolvent).

Moneysave is not a party to the Investment Notes.

Conventional Investment Note:

It means any contract, agreement, note or any other document evidencing a monetary loan, executed or offered, on or through an electronic platform, where an investor expects a financial return, but does not include:

(a) any right, option or interest in respect thereof;

(b) a cheque, banker’s draft or any other bill of exchange or a letter of credit;

(c) a banknote, guarantee or an insurance policy; or

(d) a statement, passbook or other document showing any balance in a current, deposit or savings account.

Islamic Investment Note:

It means any contract, agreement, note or any other document evidencing undivided ownership or investment in any assets in compliance with Shariah principles and concepts endorsed by the Shariah Advisory Council, and is executed or offered, on or through an electronic platform where an investor expects a financial return, but does not include:

(a) any right, option or interest in respect thereof;

(b) a cheque, banker’s draft or any other bill of exchange or a letter of credit;

(c) a banknote, guarantee or a takaful policy; or

(d) a statement, passbook or other document showing any balance in a current, deposit or savings account.

Moneysave conducts a preliminary screening based on a knock out matrix to weed out ineligible Issuers.

After an Issuer clears the preliminary screening, a credit evaluation will be performed covering (amongst others):

- Purpose of facility

- Financial analysis

- Management capability

- Repayment capabilities

- Collateral/security

- Others

To be eligible, your company:

- Incorporated in Malaysia with a minimum of 30% shareholding by Malaysian citizens

- Either a sole proprietorship, partnership, incorporated limited liability partnerships, private limited company or an unlisted public company

- Operating for at least 6 months

You will be in investing in Malaysian SMEs that have passed through our rigorous credit assessment. We encourage our investors to check the factsheet of the investment opportunity before investing.

We request for the standard set of company and financial documents for further assessment of the financial performance of the company and verify the credit reporting agencies of the Issuer, Directors and Guarantors and check for credit litigation history against the company.

If the verification is satisfactory, we will then schedule a site visit to the issuer’s business premises where we assess their willingness and ability to finance the repayments.

Moneysave reserves the right to suspend or terminate a member’s account if it appears an account has been used in breach of the Code of Conduct or any applicable laws.

Only registered and qualified members (with Investor or Business accounts) of Moneysave can gain access to the information and services provided by the platform. Information provided on our platform is strictly confidential. Identification proofs are required and will be verified when creating an account with us.

However, Moneysave does open with limited access to the public to view investment opportunities. Prospective Investor is requested to sign up for an account if they are keen to invest in the Investment Notes published or issued on the platform.

A rescheduling and restructuring of Financing Facilities involves any modification made to the original payment terms and conditions of the facility following an increase in the credit risk/deterioration in creditworthiness of the Issuer. This is to better suit the Issuer’s ability to conduct payments and the possibility of collections from the Issuer.

The payment structure may be rescheduled or restructured in respect of financing tenure, Principal, Profit, late payment and any other terms of payment.

This includes both bullet and periodic repayment facilities requiring refinancing

The Issuers are given 7 days grace period to make the payment from the date that the payment is due. Thereafter, Moneysave may charge for late payment and/or any additional profits.

Generally, if the payment is made after the grace period and/or without reasonable reason provided by the Issuer:

For Conventional Investment Note:

Late Payment Interest of up to 0.1% per day from the unpaid amount will be charged

For Shariah Investment Note:

Late Payment Charges of 10% per annum (if applicable) will be charged 3 days after the Payment Due Date. Please note that investors are only entitled Ta’widh amount up to a maximum of 1% p.a. of the Principal Outstanding amount due. The remaining amount shall be recognized as Gharamah. Ta’widh is where the compensation is made on the actual loss.

Gharamah shall not be earned as income, and shall be channelled by Moneysave, acting as agent on behalf of Investor, to charity as guided by Shariah Advisor.

The Late Payment Charge amount charged shall not be more than the outstanding principal amount.

Additional Profit (if applicable) where the Sales Price based on the Contracted Profit Period shall be accrued and payable. The amount accrued and payable shall be up to the Contracted Sale Price.

We may attempt to reschedule / restructure the payments, if necessary, to minimise any loss to P2P Investors.

Moneysave has a Living Will arrangement with Universal Trustee(M) Berhad so that in the unprecedented event that Moneysave goes out of business, the Investment Notes that have been successfully issued on the platform will be unaffected and investors will continue to receive their payments.

As investors are financing directly to businesses (Issuers), the parties to the Investment Note are between the Investors and the Issuers. These contracts remain in place and are unaffected. Moneysave has entered into a backup servicing arrangement to transfer the servicing functions of all outstanding notes to provide continuity in the event that Moneysave becomes insolvent.

A written notice shall be published to all Issuers and Investors of existing Notes on the takeover by the designated backup service provider in the event of business cessation by Moneysave.

The backup service provider shall be entitled to charge each Investor a service fee, on such periodic basis as notified to the Investors.

The backup service provider will carry out the following activities:

a) Maintain an account under a licenced financial institution in Malaysia, for the purpose of receiving and holding the monies of the Issuers and Investors of existing Investment Notes.

b) Consolidating payments from the Issuers and making payments to the registered accounts of the Investor of existing Investment Notes at the end of every month.

c) Maintaining records of all transactions relating to the Investment Notes.

d) Responding to queries of the Issuer and Investors of existing Investment Notes.

e) Facilitate the Recovery of partial repayment, missed repayment, late or non-payment of Issuers

If you wish to close your Moneysave account, please submit a ticket at: https://moneysave.com.my/contact/.

Please provide us a scanned copy of your NRIC / Passport / Relevant Identification documents and include in your message to us ‘ Please close my account.’

Please ensure all available funds are withdrawn before closing the account and allow Moneysave up to 3 business days to process the account closure. Once we have completed the process, an email notification will be sent to you indicating that the account has been closed.

Extensions of financing facility, where appropriate, should be adequately secured. A financing package is considered secured when the entire package is fully covered by the Platform’s approved securities within an approved secured margins for authority Limit purpose.

Assets pledged to secure financing facility must meet the definition of collateral in respect of the following:

Aspect | Definition |

Legal Certainty | The Platform have clear legal rights over the collateral, and may liquidate / foreclose or retain it in the event of Issuer’s default, insolvency or bankruptcy (or other risk default events as specified in the transaction documentation) of the Issuer and where applicable the custodian holding the collateral |

Low Correlation | The credit quality of the obligor and collateral value must not have a material positive correlation such that it would render the collateral of little value should the credit quality of the obligor deteriorate. Consideration must be given to factors such as margin of advance, top-up trigger for collateral shortfall, collateral concentration level, and collateral liquidity in the assessment of the collateral value. |

Marketability | The collateral should be liquid or under normal circumstance and able to be disposed-off within a reasonable timeframe |

Identification | The collateral should be easily identifiable. If the collateral is held by a custodian, the custodian should segregate the collateral from its own |

Any collateral security for any Investment Notes would be specifically stated in the relevant Factsheet.

Please note that your investment may be subject sanctions, laws and regulations of your home country or applicable to any Party or any of its Affiliates (in particular but not limited to laws relating to tax, exchange control, anti-money laundering and anti-terrorism financing, fraud as well as data protection) if you are an investor residing, or you have your principal place of business, outside of Malaysia.

You shall be responsible for your own tax liabilities, transaction costs and capital controls which may be imposed by the laws of your home country.

Any information about you and/or your investment shall be disclosed by Moneysave if it is necessary to comply with any applicable law, regulation, court order or governmental request. We shall not be held liable for any action taken by the authorities against you for your failure to comply with the applicable laws.

If you are unsure about your legal obligations under the laws of your home country which may be applicable on to you and/or your investment on this platform, you shall seek advice from an independent Financial Planning Advisor, legal counsel or similar professional.

The Investor authorises Moneysave to initiate legal action against the Issuer in the event the Issuer does not make any further payment within fourteen (14) days from the date of demand subject to at least 51% (by Investment Value) of the Investors agreeing to proceed with such action and funded the cost of recovery.

The Islamic Investment Notes is based on the concept of Commodity Murabahah via Tawarruq arrangement. Murabahah refers to a sale and purchase of an asset where the acquisition cost and the mark-up are disclosed to the purchaser.

Tawarruq is an arrangement which consists of two sale and purchase contracts. The first contract involves the sale of an asset by a seller to a purchaser on a Murabahah basis involving a cost-plus profit for a deferred payment. Subsequently (and under the second contract), the purchaser of the first sale will sell the same asset, at cost, to a third party on a cash and spot basis.

In the contract, Moneysave shall be appointed as agent by both Investor(s) and Issuer to execute the Murabahah via Tawarruq arrangement sale and purchase.

Moneysave may classify any of the Investment Notes as Default Investment Note upon the occurrence of any of the events as follows:

- the Investment Note being overdue in payment from the Payment Due Date;

- the Issuer or, in relation to Business Term Financing, the Issuer’s trade debtor(s)/creditor(s) go into administration or liquidation (as the case may be);

- the Issuer or, in relation to Business Term Financing, the Issuer’s trade debtor(s)/creditor(s), ceases or threatens to cease carrying on a substantial portion of its business;

- the P2P Operator suspects that fraud has been or may be committed by the Issuer or, in relation to Business Term Financing, the Issuer’s trade debtor(s)/creditor(s); and/or

- any breach by the Issuer of its obligations in the Issuer Agreement executed between the Issuer, the P2P Operator and the Trustee, in particular but not limited to the occurrence of an Event of Default as defined in the Issuer Agreement.

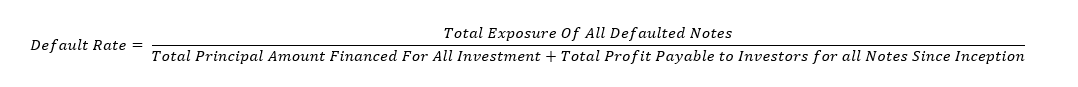

Total Exposure Of All Defaulted Notes = Outstanding Principal Amount + Outstanding Profit Due to Investors – Amount Recovered.

The denominator will essentially be the amount financed plus the interest that is promised to the Investors at point of issuance. This includes Active Notes, Defaulted Notes and Written Off Notes (if any) as follows:

Active Notes refers to Investment Notes issued on the platform which are not in default.

Defaulted Notes refers to Investment Notes which are classified as default as per Moneysave’s definition.

Written Off Notes or any similar definition refers to Investment Notes which are in default and have not yet been recovered.

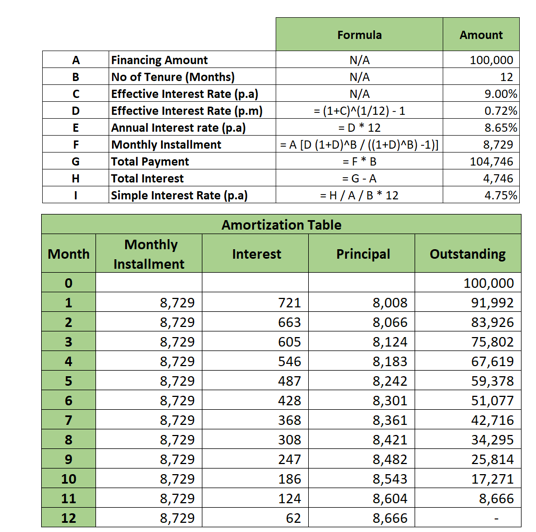

An Investment Note consists of 3 main components: the principal amount, the interest rate and the number of months of repayment. There are many types of interest rate calculations. The two most common types are Simple Interest Rate and Effective Interest Rate.

SIMPLE INTEREST (PROFIT) RATE

When an interest rate is quoted as a flat rate, it means that the interest due is calculated as simple interest on the amount of the financing. As the name suggests, simple interest rate (or flat rate) is the easiest to understand and is a quick way to calculating interest. Hence, this is the preferred interest rate reference at Moneysave, as it will be easy for Investors (Issuers) to understand the actual returns (actual rate of interest) that is expected from each Investment Note.

Monthly Simple Interest Amount = Principal * Simple Interest Rate / 12

Total Simple Interest Amount = Monthly Simple Interest Amount * Financing Term (in months)

Example:

Investment amount: RM 100,000

Investment term: 12 months

Simple interest rate: 9% p.a.

Total dollar return for investors: RM 100,000 * 9% p.a. = RM 9,000

Repayment from Issuers / to investors are in equal monthly payments of principal and interest.

EFFECTIVE INTEREST (PROFIT) RATE

Effective interest rate calculates the returns as if the monthly payment is reinvested at the same rate of interest until the end of the financing tenure. The effective interest rate takes into account of the compounding effect and the frequency of instalments over the period.

There is no straightforward formula, but it can be calculated (by way of iteration) using the RATE function in Excel as follows:

RATE (nper, pmt, pv, [fv], [type], [guess])

- nper : Number of payment periods

- pmt : Payment made each period, includes principal and interest but not fees

- pv : The present value that a series of future payments is worth now

- fv : The future value that you attain after the final payment is made.

- type: Optional. Use 0 if payments are due at the end of the period, or 1 if payment is due at the beginning of the period. If omitted, 0 is assumed.

- guess: Optional. Variant specifying value you estimate will be the returned by Rate. If omitted, guess is 0.1 (10 percent).

Assuming you take a RM100,000 financing for 12 months, and the Effective Interest Rate is = 9.00% p.a.

Then the Simple Interest Rate is actually = 4.75% p.a. This corresponds to Annual Interest Rate = 8.65% p.a.

1.Effective, Simple and Annual Interest Rates are different methods of calculating interest rates. However, the amount of interest that the Issuer pays remain the same. (I.e. Effective 9.00% vs Annual 8.65% vs Simple 4.75% are the same)

2.A Simple Interest Rate of 4.75% sounds more enticing than both Effective (9.00%) and Annual (8.65%) interest rate. This may mislead an Issuer to believe that his/her interest rate is lower if Simple Interest Rate was to be used as a basis of computation.

This is best explained with an illustration as follows:

Simple Interest Rate is calculated as follows:

Formula: (Total interest paid in a year/ Principal loan amount) * 100 = 4.75%

However, Annual Interest Rate is calculated as follows:

Formula: (Interest paid in a month/ Outstanding loan amount) * number of months in a year

(721/100,000) X 12 = 8.65% (Annual Interest Rate)

(663/91,992) X 12 = 8.65% (Annual Interest Rate)

Didn't answer your question?

Feel free to contact our team of specialist to help you find the answers to what you need.